Engagement Report

Objetive & Introduction

This article will provide International Waste Management Executives a brief overview of the opportunities for Developments in the in the intersection between the WtE (Waste-to-Energy) and CCS (Carbon Capture & Sequestration) market spaces currently developing in the North American Region, with a particular focus in the United States. The main focus will be on WtE, followed by a shallow dive into the opportunity space tax incentives are creating for joint WtE and CCS-enabled projects. In spite of the current Global Pandemic, the growing population and rise in living standards are producing ever greater quantities of municipal solid waste (MSW). At the same time, this same growth also drives ever-larger demand for energy, particularly electricity.

A key double-sided solution to manage these huge quantities of waste, rising energy demand and methane emissions produced from MSW is the technology of Waste-to-Energy (WtE) and Carbon Capture and Sequestration (CCS). Ecoprog (2018) estimates that there are more than 2400 WtE plants operating globally. And that by 2027, this number will have risen to 2700 plants with an overall capacity to process 530 MM tons of waste. With this technology, one that a number of engineering companies have mastered (particularly in Europe), energy is generated in the form of electricity and heat via the oxidative processing of waste. Furthermore, adding CCS to WtE has the potential to turn new WtE projects into zero or even negative CO2 emissions energy sources, depending upon the origin of the wastes involved.

This Luxmath Consulting short report provides an overview of Waste-to-Energy, including how it works in the United States, its relation to climate change goals and local environmental regulations, and the possible sources of financing and tax incentives for these projects.

The overview follows.

WtE in the United States

The WtE concept experienced a growth period in the United States starting in the late 1980s and well into the early 21st century. As of 2010, there existed ~90 WtE plants in the country. But by 2019, this number had reduced to 75 plants. These shutdowns were due to: i) Economic factors (lower electricity costs, subsidies to the renewable energy industry), ii) community worries about the technology (the NIMBY effect: not-in-my-backyard) and; iii) enhanced regulatory demands (clean air act, solid waste regulations particularly for fly-ash with high heavy metal contents).

Of these ~75 plants, 44 belong to Covanta (www.covanta.com). This company claims its WtE facilities annually convert 21 million tons of waste into power for over one million homes and recycle ~500,000 tons of metal.

Covanta has realized that the market in the US demands a differentiated approach to what is required in other countries. This is the reason why it is investing in new BECCS (Bio-energy with Carbon Capture and Storage) technology, offering other landfilling alternatives beyond burning (i.e.: Composting) to select industrial markets with specific sustainability goals and in the metals recovery space. In this last space, metals recovery, the company claims to have advanced technology which extracts metals from the fly ash produced in its WtE plants. Other similar companies, such as Wheelabrator, are copying this move by building their own ash processing and metal recovery facilities. All in the meanwhile, the older, smaller facilities in the United States are being closed down due to the lower electricity prices and the lower costs of processing for landfills and challenges in securing enough municipal waste (there has been an increased traffic of waste from the USA to Asia in this past decade).

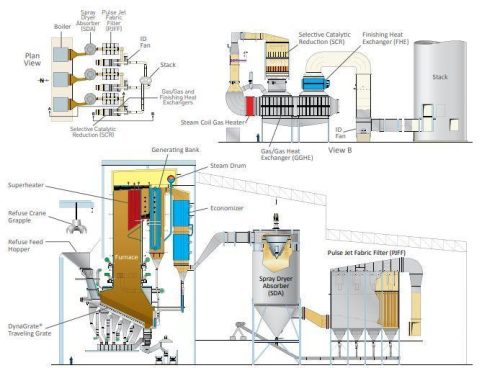

One county that has gone against the trend is Palm Beach County in Florida. This semi-tropical state has a very fragile ecosystem and an ever-growing population, which prefers life in the balmier “Sun Belt”. What this implies is an increased availability of municipal waste. With engineering and equipment by Babcock & Wilcox, and engineering company out of Denmark, Palm Beach County launched a project aimed at increasing its WtE capacity by buiding a second, larger plant. They had had the experience of operating a 2000 ton/day plant (REF1) for twenty years before the decision to build REF2, which certainly helped in driving the decision from the community standpoint.

Thus, with $600MM in industrial revenue bonds for the recycling plant and $56MM from the Florida Power & Light Company invested in generation capacity, the county set itself to use the many years of technological advancements that were fruit of hundreds of WtE projects in Europe and Asia. According to the County, REF2 was designed with the strictest environmental control technologies in the market such as B&W’s dynacrate combustion systems and special NOx emissions reducers using selective catalytic converters.

The plant was thus designed with the objective of minimizing the amount of waste going to the landfill (by ~ 90%), ensuring the local landfill can last well into 2045. Also, it generates 100 MW of electricity which feeds an estimate forty-five thousand (45000) homes and businesses in Palm Beach. At capacity, the plant processes 3000 tons of post-recycled municipal solid waste (via three 1000 t/day B&W boilers). It recovers 90% of ferrous metals and ~86% of non-ferrous metals from the ashes after the incineration process. This would equate to more than 27000 tons of Al, Cu, Fe and other metals recovered on an annual basis.

A key learning point learnt from this project, according to the county officers, is that WtE plants are not expected to be competitive everywhere. The cost of solid waste disposal in landfills by municipalities happens to be a key parameter for the gono go decision. A significant number of municipalities in the United States can achieve this for under $25 per ton of SMW (solid municipal waste). Now, for the case of Palm Beach’s RF2 plant, their cost of processing the MW was ~$25, which equated to the cost of disposing the MW in their landfill (which is small and had very stringent environmental goals). So, although economically both solutions were at the point of indifference, Palm Beach’s Solid Waste Authority on the other hand has been able to earn extra millions of dollars in revenue by selling power back to the community and from the cash stream of its recycled metals. Also, it extended the life of the existing landfill, avoiding expensive permitting processes and construction of new landfill sites. So, for the business developer, a natural question that arises is: Where in the United States, other than Palm Beach, could WtE projects be viable, taking into account the cost for municipalities to dispose of its waste being larger than $25/ton of MSW (Municipal Solid Waste)? Actually, in many Florida Counties as well as large urban areas such as NYC, Chicago, HoustonDallas-Austin-San Antonio, Cleveland, Minneapolis, Seattle, Portland, Denver & Salt Lake City among others landfill costs are well into the $40s and $50s / ton MSW. And what if suddenly these costs were to rise due to market and political drivers?

The China-United States Cold War on Trash

Driving this uptick in costs for MSW landfilling Worldwide is the fact that China, one of the largest importers of foreign trash, decided since 2018 to place a ban on the importation of plastic waste. Its main suppliers up to that point had been the United States, the EU and Australia. China’s action came as a consequence of many state-side recycling programs transitioning away from requiring consumers to separate paper, plastics, cans, and bottles into today’s more common “single stream,” where it all goes into the same blue bin. As a result, contamination from food and waste has risen, leaving significant amounts of MSW unusable and/or unexportable. In addition, plastic packaging has become increasingly complex, with colors, additives, and multilayer, mixed compositions making it ever more difficult to recycle. Thus, China has now cut off imports of all but the cleanest and highest-grade waste streams, imposing a 99.5% purity standard that most exporters just found impossible to meet. As a result of this decision, costs associated with recycling for municipalities is up whilst revenues associated with recycling have been declining. Furthermore, it is expected that over the coming decade as many as 110 MM tons of plastics will need to find a place for either being recycled or otherwise disposed. To complicate matters, the current economic cold war between the US and China has only worsened the situation. Prior to the Chinese ban, 95 percent of the plastics collected for recycling in the EU and 70 percent of US collections were being sold and shipped to China on the empty (low cost) containers that had originally carried exported Chinese finished products into these markets. This had helped balance the import-export parities and logistical costs significantly, steady state that has been affected by the unilateral Chinese ban on low quality MSW and by the current pandemic and the demand slow-down.

Now, interest in WtE (Waste-to-Energy) solutions has been on the rise due to this situation. In Philadelphia in 2018, for example, the city’s waste processor demanded higher fees for collecting and processing recycled materials. Because of this, the city decided to send half its recyclables to a WtE plant. In parts of Europe, similar situations are taking place as well. And in the United Kingdom, nearly 11 MM tons of waste were burned at WtE plants last year, up 665,000 tons from the previous fiscal year. Since WtE facilities based on the newer technologies are designed to contain and mitigate emissions, the practice has strong proponents for and against among environmentalists and scientists. One of the main causes for concern, still, is that most stateof-the-art incinerators can emit dioxins and other harmful pollutants that have a high probability of ending up in the atmosphere or, worse case, in nearby water reservoirs or migrate into the nearby water tables. Still, this dynamic is lending itself for a potential rebirth in the interest to develop WtE facilties in the United States and Canada.

Particularly since, as explained earlier, much of the waste ready for recycling (non-biogenic) is becoming cross-contaminated with organic waste (biogenic). On top of things, this also ends up having an environmental cost (externality) given that, if this waste ends up in landfills, it will decompose and emit methane (CH4) to the atmosphere. As is well acknowledged, CH4 is a potent, high GWP (global warming potential) gas. And landfills, after all, are the third largest source of methane emissions in the United States (right behind the oil and gas and the intensive cattle/meat production industries). Now, it is a certainty that WtE plants still emit carbon dioxide and potentially other gases. As a way to solve this, some actors have begun to explore ways to minimize even further the environmental footprint of these plants via CCS (Carbon Capture and Sequestration) solutions.

A WtE + CCS Combo to go for your Climate Change and Waste Management woes?

As we mentioned earlier, landfilling and dumping MSW is a rather unsustainable proposition. Not only large areas of land are required, but also these result in significant pollutants accessing the atmosphere (as global warming gases) or the water tables (as heavy metal salts or long-life organic contaminants). Landfill storage sites near major urban centers, unable to cheaply export their MSW due to market and political dynamics, are coming under intense capacity pressure and this is resulting in rising landfill charges by municipalities.

An affordable solution to the challenges included in MSW disposal, rising energy demand by a population and reduction of methane emissions from MSW in landfills comes in the way of Waste-to-Energy (WtE) projects. And the addition of carbon capture and storage (CCS) to WtE has the potential to make waste a zero or even negative emissions energy source, depending on the ratio between biogenic (biological carbon stemming mainly food waste/plant derived) and non-biogenic (nonbiological carbon mainly fossil-fuel derived) waste. When MSW is incinerated, the atmospheric CO2 balance going to the atmosphere is increased mostly due to the non-biogenic waste (the biogenic carbon came from atmospheric CO2 after all involved in the carbon cycle). And as we have explained in the previous section, the percentage of non-biogenic waste is increasing in the MSW streams. This is thus driving a net increase in anthropogenically-derived carbon entering the atmosphere. In a typical carbon balance scenario, for every 100 tons of MSW, 8 of these tons are biogenic carbon materials and 11 tons are non-biogenic carbon materials. The incineration of these material would produce ~ 29 tons of CO2 from biogenic sources and 40 tons of CO2 from non-biogenic.

If a CCS project were able to capture a larger fraction than that from the biogenic carbon materials, then that facility would technically become a net-negative Carbon Dioxide emitter. So, for WtE plants operating on MSW with a significant biogenic component, CCS can provide a pathway to negative atmospheric carbon emissions whilst at the same time producing the power and handling the waste produced by our growing populations and economies. An even more interesting angle to consider is that flue gases from WtE plants are similar to those produced by coal-fired power plants. And since WtE feed streams contain less sulphurated compounds and produce less particulates than coal, less CAPEX is required for pre-CCS gas cleaning processing (compared to that required for CCSing a flue gas from a coal plant). Current developments in CCS process innovation, integration and intensification could potentially lower the capture cost to USD 30-40/ton of CO2 in power generation applications. And furthermore, the United States Treasury department has recently (2018) passed a tax law that may allow for a simpler mechanism to support the financing of the CCS component in joint WtE + CCS projects.

A Landmark Bill from the least expected source

Back in February 2018, the President of the United States signed a bill which included two new pieces of legislation. These both, unexpectedly and non-obviously, contain the spark that may become ultimately keystones for propping the development of the next cutting-edge technologies that can help the World fight against climate change. The 45J nuclear-power production credits and the 45Q tax credits for carbon capture.

Of particular interest for this article is the 45Q tax credits bill, and this is how things would work. Say, any new fossil-fuel power plant and/or carbon-dioxide-producing industry (steel, cement, aluminum or plants required to process the strategic metals critical for the advancement of renewable energy and EV transportation) that commences construction before 2024 can be eligible for tax credits for up to twelve years (with a time cap on the credits). The tax credits offered are measured on a “per metric ton of carbon dioxide captured” basis. So, these add up to $35 / ton of CO2 if the carbon dioxide is put to use (i.e in EOR or Enhanced Oil Recovery, improving oil productivities from low-cost mature fields) or up to $50/ ton of CO2 if it is simply buried in and underground storage (a.k.a. Geological CCS).

An earlier existing tax credit was limited to 75 million tons of captured CO2 and paid out only $20 per metric ton. Some large fossil fuel companies like ExxonMobil did use this tax credit, but only at sites that could conveniently capture CO2 from natural gas separation plants and pipe it to regional oil producers for EOR.

It is generally expected by the experts in the field that the 45Q bill will change the cost equation for CCS projects in the United States and that it will do for CCS projects what subsidies did a few decades ago for solar and wind power development. Already large CO2 producers such as Ethanol, Methanol, Ammonia and Cement producers are beginning to study ways in which they can benefit.

Now, clearly, projects with WtE + CCS projects could also be considered in claiming the tax breaks from 45Q, and even in as much due to the potential for Carbon Negativity explained earlier (with the higher biogenic components observed in the waste streams).

Competing technologies. Namely: trash gasification

Although WtE projects in the US have been mostly focused on incineration of MSW, there are other companies which believe there is a cleaner alternative: MSW gasification. The process involves the creation of syngas (H2 + CO2) via the application of steam and or oxygen at temperatures above 3000 degrees F. Two companies are taking the lead in exploring these technologies. Sierra Energy is based out of California and has the backing of some deep-pocketed investors, including Bill Gates. The other one, from Houston Texas, is calle Systems International.

Actually, Systems International has reported that it is planning to unveil two plants in Texas, near Houston. These trash gasification pilots would involve 120 MW electricity generation plants, with both plants costing ~$800 MM dollars. The company presented a financial plan for the development of these plants based on the issuance of $650 MM dollars under taxable corporate bonds underwritten by Wells Fargo. The other $150 MM dollars necessary would come as a private equity instrument tied to 45Q-related federal tax credits for CCS.

And there are many other companies that are looking into gasification as a means to turn trash into energy, fuels and chemicals. But we will get into these details on a future article.

Conclusions

• Relevant dynamics are playing in the direction of a revival for projects involving Municipal Solid Waste as a raw material for energy, fuels and chemicals as exemplified in the Palm Beach, FL REF 2 project.

• Due to the China-USA economic cold war, MSW composition changes driven by municipalities relaxing waste separation practices at homes and Chinese regulatory changes, the costs of managing waste in the USA is increasing.

• Also, the regulatory issues for municipalities involved in permitting for new landfills as well as an increase in population and energy demand (particularly in the Sun Belt and in ecologically sensitive areas) makes the alternative of Waste-toEnergy projects a viable one.

• A new tax incentive for Carbon Capture and Sequestration (45Q) may lead to the adoption of CCS in conjunction with waste-to-energy and waste- to-high value materials projects as an optimal ESG solution.

• WtE plants with CCS can be considered carbon-negative and thus be able to claim the carbon tax credits from 45Q.

• There are a number of entrepreneurs, spurred by 45Q, seeking to develop gasification technologies that may ultimately prove a low cost, high efficiency winner of this technological race.

Luxmath would welcome the opportunity to explore with engineering firms and entrepreneurs the justification of projects as well as the commercialization of technological solutions for the North American market in this nascent space. A deeper analysis for the market space, its value chain with key players and a business development & commercialization plan can be pursued.

W Hitters – Luxmath Consulting – Houston, TX / September 2020

References

(1) “Clean Power from Burning Trash” – J Kitto & L Hiner (2017). Mechanical Engineering Magazine – Vol 139

(2) “Waste to Energy with CCS: A pathway to carbon-negative power generation” – D Kearns (2019) – Global CCS Institute

(3) “Aker Solutions to provide carbon capture technology to waste-to-energy plants” – A Doyle (2019) – The Chemical Engineer

(4) “Intergovernmental Panel on Climate Change” (2018). Global warming of 1.5°C, s.l.: Intergovernmental Panel on Climate Change.

(5) “What a Waste 2.0: A Global Snapshot of Solid Waste Management to 2050” (2018) – The World Bank – Washington, DC, USA

(6) “Solid Waste Management” (2019) [Online] Available at: https://www.worldbank.org/en/topic/urbandevelopment/brief/solidwaste-management

(7) “World-Class Technology for the Newest Waste-to-Energy Plant in the United States – Palm Beach Renewable Energy Facility No.2” – J Kitto, M Flick, L Hiner, W Arvan, R Schauer from B&W Co, Palm Beach Resource Recovery Corp and Solid Waste Authority of Palm Beach County (2016) – Renewable Energy World International – Orlando, FL

(8) “Energy Recovery from the Combustion of Municipal Solid Waste” (2019) [Online] Available at: https://www.epa.gov/smm/energyrecovery-combustion-municipal-solid-waste-msw

(9) “Piling Up: How China’s Ban on Importing Waste Has Stalled Global Recycling” – C Katz (2019) – e360.yale.edu

(10) “The next low-carbon energy source? It might be trash” – E Klump (2020) – E&E News

(11) “Transport infrastructure for Carbon Capture and Storage” E Abramons et al. (2020) – Great Plains Institute

(12) “45Q, the tax credit that is luring US companies to capture CO2” – M Bomgardner (2020) – C&EN Magazine – Vol 98. Is. 8

(13) “The Tax Credit for Carbon Sequestration (Section 45Q)” – March 2020 – Congressional Research Service (CRS)

(14) “45Q Tax Credit” – (2020) [Online] Available at: https://carboncapturecoalition.org/45q-legislation/